Cover for non-PHARMAC funded medicines

Not all medicines are funded in New Zealand

In New Zealand, we have required standards of quality, safety and effectiveness that all medicines need to meet.

Why you might need a non-PHARMAC funded option

Here’s a typical treatment journey in New Zealand that shows how private health insurance can support you, compared to getting treatment through the public health system.

A typical treatment journey goes like this:

You feel unwell and go to see your doctor.

If your GP thinks you need further assessment or treatment, they may refer you to a specialist or hospital.

As part of your treatment, you may be prescribed drugs by your specialist.

These drugs may or may not be covered by PHARMAC

If they’re covered by PHARMAC your Hospital plan will help pay for these drugs, if they’re prescribed by a specialist.

However, not every treatment has a funded drug available. Sometimes, non-PHARMAC funded drugs are the best available, or the only option for your treatment.

If you’re prescribed non-PHARMAC drugs, you’ll need to have non-PHARMAC drug cover otherwise you’ll need to pay for them out of your own pocket.

Who pays?

Referred for treatment – specialist or hospital

PHARMAC drugs needed for treatment

Public health system pays – risk of long wait times and less control over who treats you and when

non-PHARMAC drugs needed for treatment

You pay or nib may pay if you have private health insurance

What will it cost me if I don’t have non-PHARMAC drug cover?

If you need a non-PHARMAC funded drug, treatment can potentially end up costing hundreds of thousands of dollars. Adding an option for non-PHARMAC drugs to your health insurance will:

- Give you more control over your treatment options

- Allow you to access more expensive treatments

- Reduce the cost for you and your loved ones when this treatment is required

Here are some approximate cost examples of non-PHARMAC drug treatments, without non-PHARMAC drug cover*.

$59k

Asthma

$137k

Bladder Cancer

$86k

Breast Cancer

$100k

Cervical Cancer

$75k

Colorectal Cancer

$43k

Crohn’s Disease / Inflammatory Bowel

$212k

Lymphoma

$168k

Leukaemia

$167k

Lung Cancer

$76k

Multiple Myeloma Cancer

$10k

Ovarian Cancer

$10k

Pancreatic Cancer

$51k

Prostate Cancer

$416k

Renal Cancer

$77k

Rheumatoid Arthritis

$93k

Skin Cancer

*Costs are based on an average person of 75kg with an average BMI (Body Mass Index), and costings are from PHARMAC submissions, https://www.eviq.org.au/ and www.Drugs.com compiled in August 2021. Indicative costs shown are either annual estimates or average indicative costs for a round of treatment. This is not a representation of conditions covered on your policy or the amount that would be paid by nib in the event of a claim.

Find the right cover for you

To give you peace of mind, we can provide cover for Medsafe-approved, non-PHARMAC funded drugs prescribed in line with Medsafe’s guidelines as an option added to your eligible Hospital plan.

You can choose the level of cover that’s right for you with our non-PHARMAC Plus option. The cover level is the maximum amount we’ll pay towards your eligible claims every policy year for each member covered.

This is a summary of the non-PHARMAC cover only. You can find out more details about non-PHARMAC Plus online, in your policy document or view the full non-PHARMAC terms and conditions.

Adding non-PHARMAC Plus

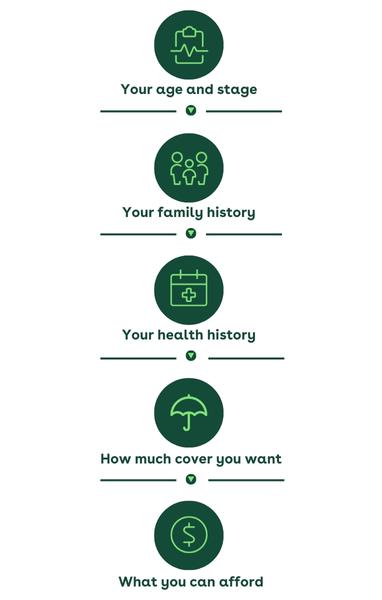

To help you choose the right level of cover, here are some of the key things that you might want to consider as part of your decision.

You can add non-PHARMAC Plus to your eligible Hospital plan - for any member on your policy at any time.

If you’re new to nib, you can buy non-PHARMAC Plus with a Hospital plan directly from us or talk to your independent financial adviser about the options that are available to you.

If you already have a health insurance plan with nib, adding non-PHARMAC Plus is easy. Simply fill out our online form.